Orion Farming Group Weekly Straights Update: 10th July 2025

- Orion Farming Group

- Jul 10, 2025

- 3 min read

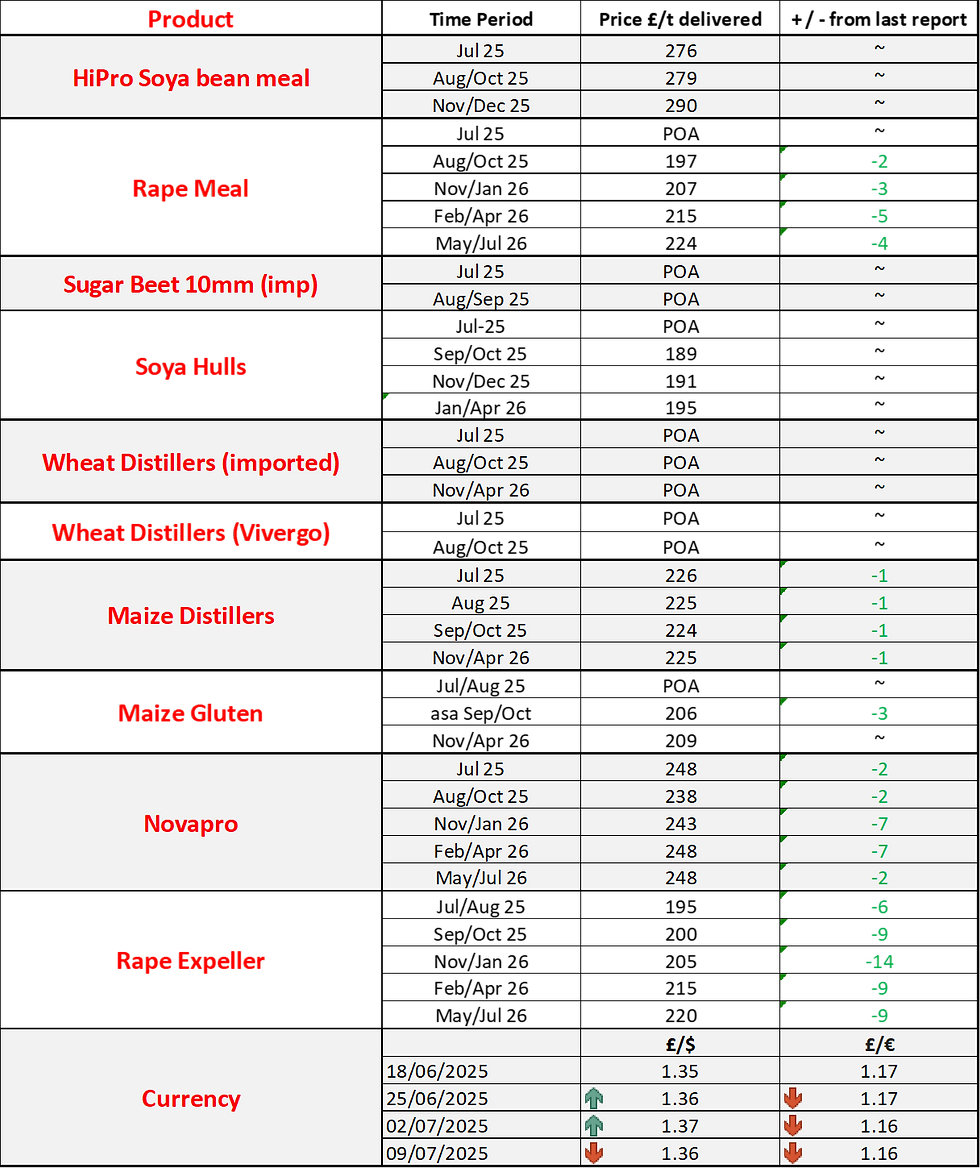

The figures in the charts are an indication only and reflect levels traded on Wednesday.

Click on a product name for more information

The second half of last week brought firmer prices due to a number of reasons.

Firstly up was weaker sterling, dropping back to $1.34 at one point.

Secondly, short covering ahead of the July 4th holiday and also short covering ahead of an expected announcement from Trump of further trade deals/ag purchases (which didn’t happen).

With good growing conditions in the US and a lack of further trade deals, the market gave back its gains at the beginning of the week.

US soya beans are rated 66% good-excellent.

The progress of the crop is in line with last year.

Overall still a good situation to be in, but last week was a timely reminder of how quickly the market can reverse, if it wants to.

Prices moved back a little further on the forward positions, though premiums for winter remains fairly large (in line with soya).

Nearby availability is very tight from Erith, but there is still imported material across the country, so prices have not firmed too much nearby.

Fundamentally, there are still limited crops in the UK/Europe and yields are expected to be variable/below average given the dry weather.

The main bearish factor in the rapemeal market is the Canadian seed import potential for winter and also the soya market which continues to pressure rapemeal prices..

Similar levels offered, with a little reduction nearby as boats start to arrive and supply easing up for the summer again.

Given the price difference with sugarbeet, demand for hulls is expected to stay high – which could limit downward pressure on prices as seen over the past 6 months.

No change week on week, with no news out of either UK ethanol plants.

Expectation is still for large amounts of US distillers due to their increase in estimated production, though it doesn’t compete against rapemeal at present.

Wheat distillers remain tight and very expensive due to limited supply.

The only hope of some lower prices would be if Vivergo announce they are remaining open (due to government support), but there are no indications either way, though Vivergo have begun consultations with staff despite “positive news” on the government front.

The market has tightened further for the summer with limited imported product and no home produce product until new crop.

New crop values are expected to be quite a bit higher than last year, but nothing has been offered yet, likely due to suppliers wanting to see how the crop fares over this dry weather.

It does call into question what yields will be seen.

Harvest has begun in the northern hemisphere, with some winter barley in the shed in the UK, with early yields not looking as terrible as expected.

The US wheat harvest is now 53% complete, which is almost back to the 5 year average, though lags behind last year.

France have also started harvesting with 11% complete.

Europe and the UK is expected to be an early harvest overall, due to the conditions.

No reports on wheat yields yet, but expectations are low in the UK.

Spring crops are expected to be poor due to the weather, but UK prices still don’t compete against imported, so it’s hard for prices to rally against that backdrop.

And finally, totally irrelevant but quite interesting facts of the week…….

Eating 20 million bananas would give you a fatal dose of radioactivity and if you ate in a different New York eatery every day for 12 years, you still wouldn’t have visited all of the city’s restaurants.

Notes:

All figures in this report are provided by KW and commentary by GLW Feeds. Price indications are based on 29t bulk tipped loads delivered to Oxfordshire and are guide prices only.

For firm prices and availability, please contact Joe Cobb on 01865 393 139

Historical Product Prices

You can look back at previous product prices here

Use the filters below to select the Product and the Date

Spot Price Trends 01/01/24 to 09/07/25 (£/t)

'Price at Fixed GBP to USD (Jan 2018)' takes out the effect of exchange rate movements between £ vs. $

Currency Trends as of 09/07/2025. Blue = GBP:USD. Red = GBP:EUR

Applications and Data Analytics for Orion developed by Demand Economics Ltd.