Orion Farming Group Weekly Straights Update: 11th September 2025

- Orion Farming Group

- Sep 11, 2025

- 3 min read

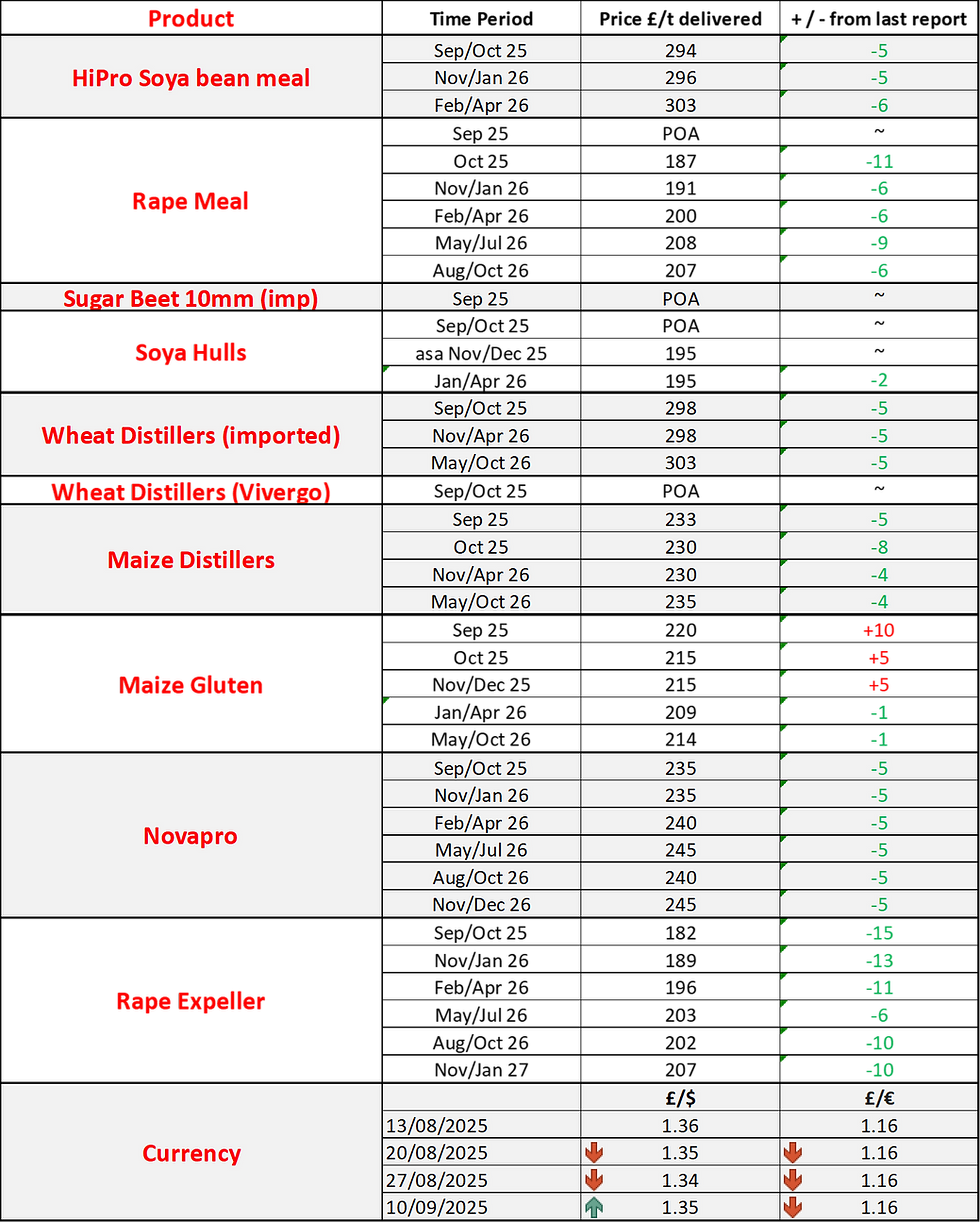

The figures in the charts are an indication only and reflect levels traded on Wednesday.

Click on a product name for more information

Prices eased a little, but for the most part the market has been quite equally balanced between dry weather in the eastern corn belt in the US and a lack of Chinese buying from the US.

16% of the soybean area is in drought vs 3% in early August increasing the likelihood of the USDA cutting projected yields in Friday’s WASDE report.

This has been eclipsed by the lack of a trade deal with China, who would typically buy their Oct and Nov beans from the US and have bought most of their Oct bean from Brazil and rumoured to be buying their Nov beans from Brazil as well.

Current export sales for new crop are 32% behind last year and trending in line with 2019, (the last time Trump picked a trade war with China).

US soybeans are currently competitively priced which could attract some other buyers, but without China a big rally in values looks unlikely.

Good weather in South America bodes well for the upcoming plantings.

Prices continued to slide slightly and look good value against hipro soya for the winter.

Next summer remains a bit more uncompetitive as a lack of trade on the Aug/Oct 26 futures means inflexible pricing.

Globally, Australia has increased their production estimates for 25/26 to 6.4MMT from 5.7MMT.

Ukraine has introduced an export tax on rapeseed to try and encourage domestic processing, which could then alter trade flows of seed and meal, though it hasn’t impacted current pricing.

A decent supply in Europe and a lack of a resolution between China and Canada means there should be a good supply of rapemeal through the winter.

Tight supply remains the main story as run-outs are being seen at various ports ahead of September’s vessel arrivals.

The market remains well sold in most ports until winter and so lower prices seem unlikely, especially considering sugarbeet supply looks likely to be down and prices up from last winter.

Imported maize distiller values continue to be supported as corn yields are expected to be lower (due to dryness) and with the Mississippi river levels dropping each week, freight rates are increasing.

There is still some concern that Chinese flagged vessels are at risk of being unable to call at US ports.

No news on whether Ensus will continue to run, as discussions with the government continue over Co2 supply.

Imported wheat distillers are creeping back as shippers continue to seek out further supply lines, but demand among feed merchants has dropped back, with most looking at cheaper maize distillers or rapemeal as a replacement in compound rations.

Home produced sugarbeet prices are still to be released but they are expected to be mid £240’s.

There are some other offers on imported, which would offer better value for sugarbeet users.

Future prices slid back a little further as pressure built from increases in Black Sea estimated production (mainly Ukraine and Russia).

Physical prices are on the whole holding steady as supply remains hand to mouth, as growers remain reluctant to discount prices and seem likely to hold out in hope of better prices.

And finally, totally irrelevant but quite interesting facts of the week…….

Avocados are not vegan and mentioning guacamole on your dating profile gets you 144% more responses.

Notes:

All figures in this report are provided by KW and commentary by GLW Feeds. Price indications are based on 29t bulk tipped loads delivered to Oxfordshire and are guide prices only.

For firm prices and availability, please contact Joe Cobb on 01865 393 139

Historical Product Prices

You can look back at previous product prices here

Use the filters below to select the Product and the Date

Spot Price Trends over the past 12 months (£/t)

'Price at Fixed GBP to USD (Jan 2018)' takes out the effect of exchange rate movements between £ vs. $

Currency Trends as of 10/09/2025. Blue = GBP:USD. Red = GBP:EUR

Applications and Data Analytics for Orion developed by Demand Economics Ltd.