Orion Farming Group Weekly Straights Update: 25th September 2025

- Orion Farming Group

- Sep 25, 2025

- 3 min read

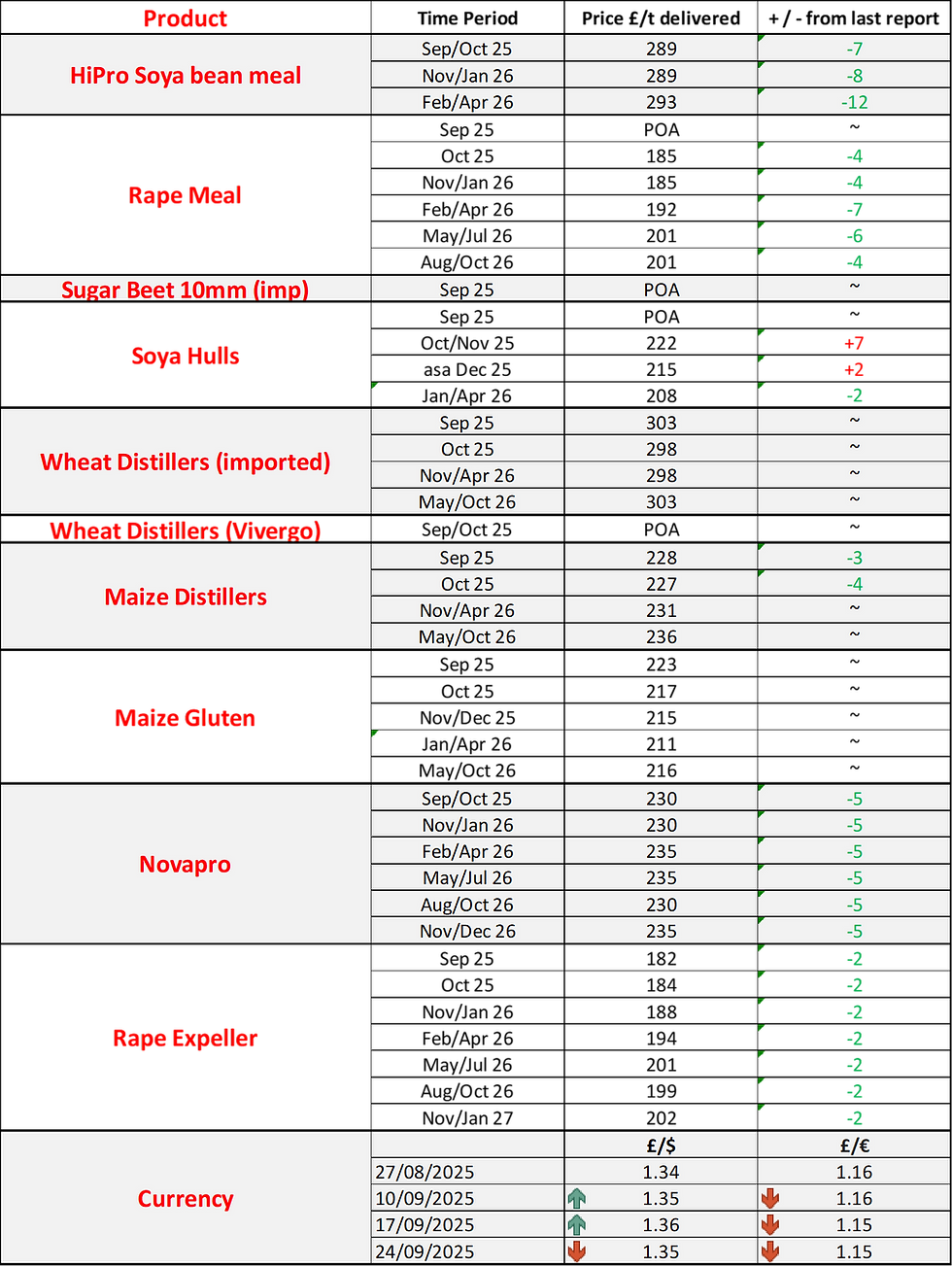

The figures in the charts are an indication only and reflect levels traded on Wednesday.

Click on a product name for more information

A week of continued bearish tone surrounding the lack of progress on a trade deal between the US and China.

Additionally harvest in the US is ramping up with the crop 9% harvested, bang on the 5-year average.

A call took place between the two presidents, but no mention of a deal on soybeans.

The two sides are due to meet in Korea in the late autumn, but the window for US exports is closing.

Rumours that Argentina/Brazil are selling November and December beans to China already – once into the new year it’s getting very close to Brazil’s harvest and new crop pricing.

Argentina are also set to suspend grain export taxes through October, which will only add competition for the US.

Usually at this point, the US are gaining market share of soybean sales over South America, but the pace is lagging 36% behind last year.

Further pressure came from the soya oil market as the EPA announced a proposal to change small refinery exemptions to reallocate 50% or 100% of them to large oil companies.

If they opt for 100% reallocation this would be bullish to oil and therefore beans, but if they opt for a smaller reallocation it would be bearish for oil/beans.

The EU is proposing another delay in the implementation of the EUDR for another 12 months, which means uncertainty from January onwards as to whether farmers will need to feed EUDR compliant soya and there won’t be any EUDR related charges applied to contracts subsequently.

Erith levels remained at similar levels for the most part with some additional pressure on forward pricing, whilst Liverpool pushed higher on all positions.

This more reflects the contrast in approach to getting sales, with Erith pricing competitively in order to try and regain some demand.

Rapemeal continues to look good value vs soya for winter positions, with Erith around 58% of the soya price, whilst Liverpool is a bit firmer around 71%

For next summer values look a bit dearer with strong premiums and minimal new crop discount.

Supply remains tight as shippers continue to see strong demand for winter offers, due to a lack of forage this year..

Further north supply is ok (though not plentiful by any means!), but prices are still strong nearby.

Further south supply is very limited until the new year.

Demand is expected to stay strong as even at these levels it looks good value vs sugarbeet offers.

Globally there is still good demand for hulls and this is keeping a base in the market.

Imported maize distillers remained firm as the lower Mississippi river levels are lower than ideal, meaning barges are unable to load with as much product, putting freight rates per tonne up.

Additionally, domestic demand for wet distillers in the UK is meaning exports need to compete for supply with that.

The markets seems to be stuck in a sideways trend, with nearby remaining a bit firmer due to demand outstripping supply in the UK.

Imported wheat distillers remains at similar levels, with demand waning in the UK as it looks very dear against other protein options.

No news on the future of Ensus, where talks are still ongoing with the government regarding support in order to secure Co2 supply.

As mentioned last week, Trident have come to the market with a farm offer, but tonnage is down significantly and prices are in the early £250’s (depending on location).

Imported sugarbeet is offered for the winter, but that doesn’t work out much cheaper (again location dependant).

Globally wheat futures markets trended down, due to increases in production estimates from various sources.

The IGC increased global wheat production for 25/26 by another 8MMT to 819 MMT

European production was also increased for 2025 to 147.4MMT, up 4.3MMT.

Canada also saw an increase of 1.9% on last year’s estimate to 36.6MMT.

As mentioned earlier in the report, Argentina suspended grain export taxes for October, which has also put grain prices under pressure, globally.

Physical farm prices in the UK still aren’t seeing the same pressure, with sellers reluctant to drop prices further – despite the bearish global tone.

And finally, totally irrelevant but quite interesting facts of the week…….

The first woman to cycle round the world learnt to ride a bike the day before she set off and if Scotland left the union, average rainfall in the UK would decrease by 8 inches.

Notes:

All figures in this report are provided by KW and commentary by GLW Feeds. Price indications are based on 29t bulk tipped loads delivered to Oxfordshire and are guide prices only.

For firm prices and availability, please contact Joe Cobb on 01865 393 139

Currency Trends as of 24/09/2025. Blue = GBP:USD. Red = GBP:EUR