Orion Farming Group Weekly Straights Update: 21st August 2025

- Orion Farming Group

- Aug 21, 2025

- 3 min read

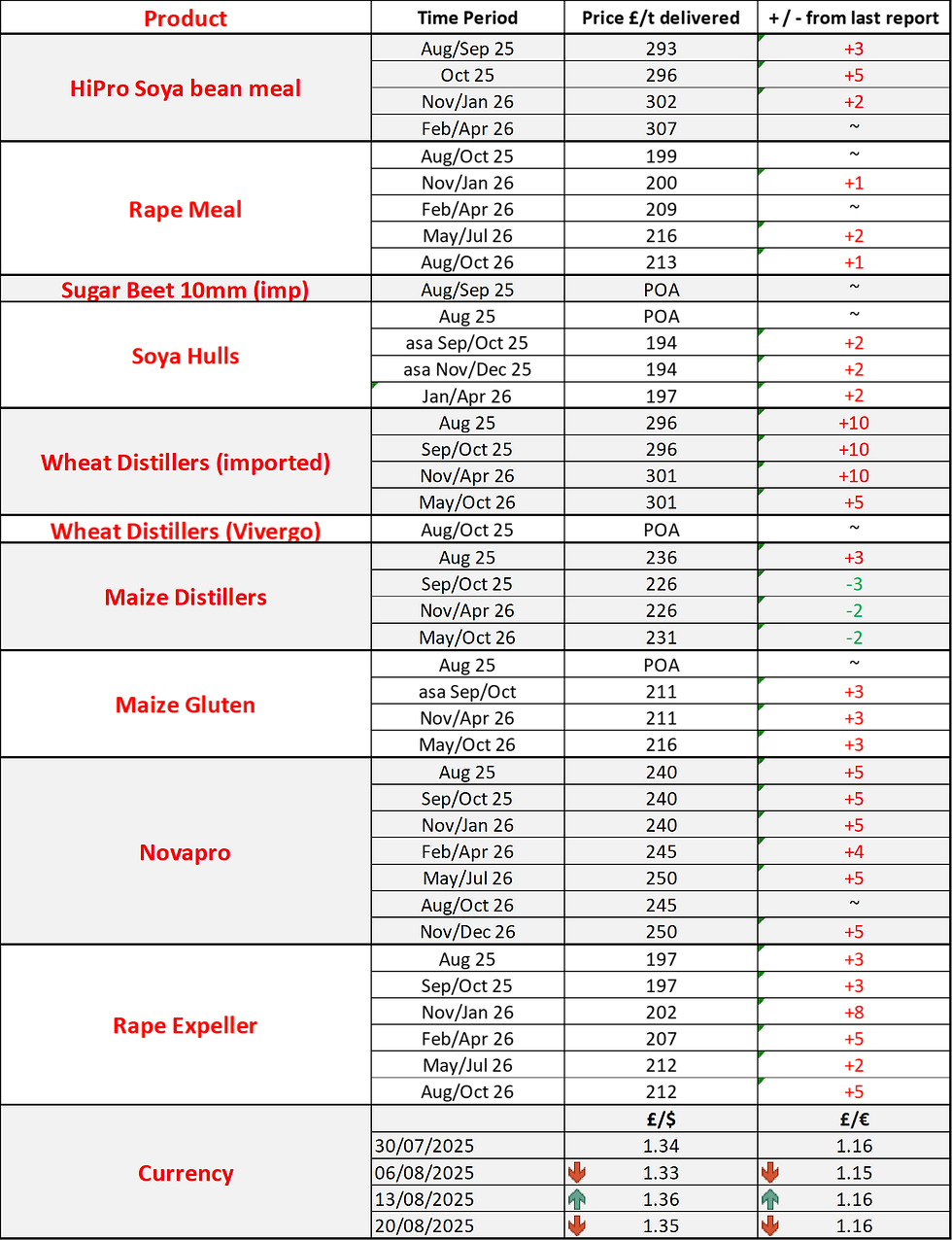

The figures in the charts are an indication only and reflect levels traded on Wednesday.

Click on a product name for more information

The USDA had a few surprises on soybeans in last week’s WASDE report, which gave the market a boost.

They did set the yield estimate at 53.6 bushels per acre (bpa) which was above the market expectation of 52.9 bpa, but they countered this with a cut to acreage which meant production was set at 116.8MMT, compared to the market expectation of 118.8MMT.

Ending stocks were also then below expectation, this pushed the soybean market higher, with meal following.

Prices held steady for the most part as soya moved up, which meant it was competing a bit better, reaching 61% of the soya price in the south on some days.

A small bounce back up was seen as there is a thin market on forward positions, with minimal trade so no exciting deals to be done.

Nearby prices have eased off as Erith came back to the market with an aggressive Aug/Oct offer following their force majeure last month.

China have contracted some Australian rapemeal to trial, which will be delivered in November with the trial results expected in January.

If the trial goes well, then it would mean another shift in global supply chains, with Canada seeking homes but less Australian material coming to the UK.

Supply is still tight nearby, with shippers selling out boats before they arrive so unavailable spot continues and ASA on the following months.

Global demand remains strong and with strong demand in the UK for fibres due to the dry weather, a significant downside is unlikely.

It still prices competitively against sugarbeet, though does still have some competition from palm kernel, though this doesn’t always feed well on farm.

Friday finally brought news that the government will not be providing financial support to the UK ethanol plants, resulting in Vivergo officially announcing its closure.

They had already ceased production and plan for the site to be demolished by the end of the year.

Ensus have yet to announce any closure on the basis that there are still ongoing discussions surrounding government support, due to the Co2 they supply, which would be more disruptive if there was a closure.

Imported maize distillers prices remain steady with a good US supply and freight rates settling.

Imported wheat distillers pellets have unsurprisingly risen on the back of the reduced supply.

No further news on home produced offers, but the market is still expecting prices to be around £235-£240.

It will probably be early-mid September before a farm offer is seen due to the dry weather and uncertainty around yields.

Imported offers are few and far between into northern ports, with the south struggling for supply.

Some further pressure on wheat futures came when Vivergo announced their closure.

UK and European producers are holding onto their grain due to low prices and so physical prices are not necessarily following the futures movements.

And finally, totally irrelevant but quite interesting facts of the week…….

The cucamelon is the size of a grape, but looks like a watermelon and tastes like a cucumber and your nose is always in your eyeline, but your brain has learned to ignore it.

Notes:

All figures in this report are provided by KW and commentary by GLW Feeds. Price indications are based on 29t bulk tipped loads delivered to Oxfordshire and are guide prices only.

For firm prices and availability, please contact Joe Cobb on 01865 393 139

Historical Product Prices

You can look back at previous product prices here

Use the filters below to select the Product and the Date

Spot Price Trends over the past 12 months (£/t)

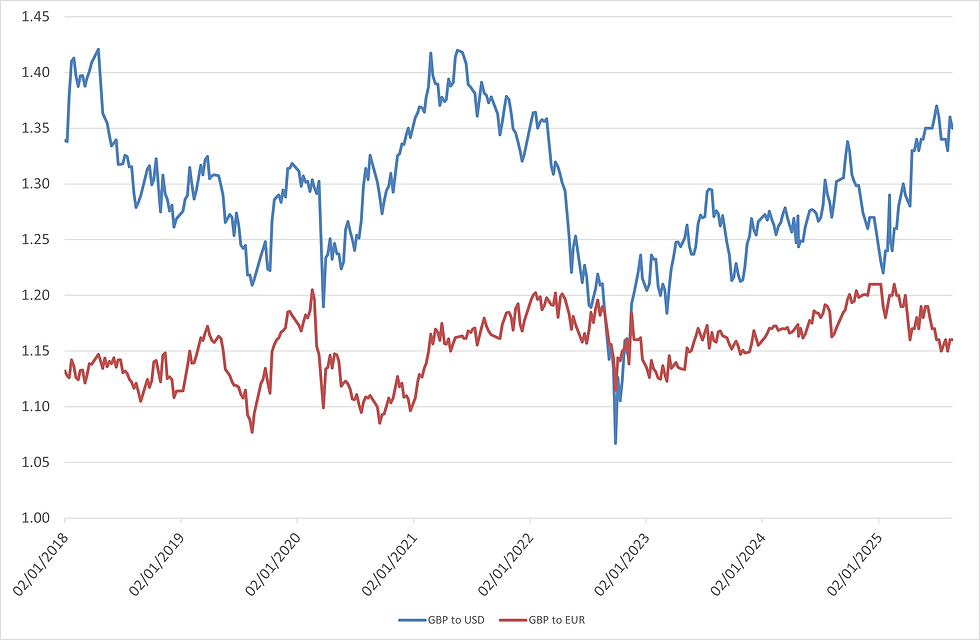

'Price at Fixed GBP to USD (Jan 2018)' takes out the effect of exchange rate movements between £ vs. $

Currency Trends as of 20/08/2025. Blue = GBP:USD. Red = GBP:EUR

Applications and Data Analytics for Orion developed by Demand Economics Ltd.